The One Percent Show with Vishal Khandelwal

An open-ended exploration into the minds of the wisest people around to help us learn to think, invest, and live each day a little, as little as one percent, better.

[If you’ve loved the show, please share a kind testimonial using this form. Thank you!]

Subscribe On

Book Recommendations

Access the list of books and other valuable resources recommended by guests on The One Percent Show. Click here to access.

Ep. 22: Kalpen Parekh on Financial Freedom, Universal Truths of Investing, and the Idea of Lifelong Learning

About

Kalpen Parekh is the Managing Director & Chief Executive Officer of DSP Mutual Fund. In this episode, we talk about the universal truths of stock investing, process vs outcome in money management, importance of lifelong learning, and much more.

Video

Audio

Ep. 21: William Green on Charlie Munger, Good Parenting, and Secrets of a Happy and Abundant Life

William Green is the author of “Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life”. In this episode, we talk about why life is more than being shrewd in wealth accumulation, impact of Charlie Munger on William’s life, Mensch Effect and the secret of real happiness, if getting richer can make you happier, and much more.

Ep. 20: Nick Maggiulli on Biggest Lies in Personal Finance, Feeling Rich, and the Role of Luck in Investing

Nick Maggiulli is the creator of Of Dollars And Data and author of ‘Just Keep Buying’ where he crunches numbers to answer the biggest questions in personal finance and investing, while providing the reader with proven ways to build wealth the right way. In this episode, we talk about the biggest lies told in personal finance, the idea of feeling rich, role of luck in investing, and much more.

Testimonials

Here’s what listeners have to say about The One Percent Show.

I had never seen this type of work in India. What you are providing to us about investing and Iife is fabulous. I cannot express my feelings in words. Keep going.

Dhyey Patel

It’s hands down one of the best podcasts not only on investing but also general life psychology. The depth and quality of questions truly unravel the nuggets of wisdom from guests’ minds. The remarkable thing about this podcast however is its candidness. The way Vishal connects with the speakers and his ability to synthesize different ideas and relate with personal experiences is truly inspiring.

Yash

Each episode brings us a new way to look at life and investing. I have 1% snowball in progress in my life and investment journey with inspiration from the show. This is by far the best YouTube Content that I have seen.

Anup Lamb

One percent show is actually a 100 % straight from heart. Every percent of show is full of wisdom. Serious investors should not miss it for sure. Impressed with Vishal’s depth of questions asked to legendary investors.

Prashant Chavan

Thank you Vishal for The One Percent Show. For me – a somebody with little finance acumen but with a keen interest in behavioural finance – your show has let me improve at least 1% with each episode!

Siva

The One Percent Show is not only about Investing. It is about everything. Investing, life, philosophy, career, education and much more.

Samrath Patidar

Ep. 19: Ian Cassel on Microcap Investing, Dealing with Self-Doubt, and the Secret of Happiness

Ian Cassel is a professional microcap investor and chief investment officer of Intelligent Fanatics Capital Management. In this episode, we talk about microcap investing, judging management quality, process vs outcome, empathy, secrets of Ian’s happiness, and much more.

Ep. 18: Kuntal Shah on Market Cycles, Lessons from Financial History, and Twelve Equations of Life

Kuntal Shah is Partner at Oaklane Capital, Co-Founder at Needl.ai, and a Board member at Flame University. In this episode, we talk about the importance of understanding stock market cycles, lessons from financial history, twelve equations of life, and much more.

Ep. 17 – Guy Spier on Warren Buffett’s Annual Meeting and the Power of Your Social Network

Guy Spier is founder and investment manager at Aquamarine Capital, and author of The Education of a Value Investor. This episode contains just one question from my side and then Guy’s lessons from visiting Warren Buffett’s Berkshire’s Annual Meeting every year and the power that our social network has on us.

Ep. 16 – Rajeev Thakkar on Investing Character, Lifelong Learning, and Building an Antifragile Life

Rajeev Thakkar is Chief Investment Officer and Director at PPFAS Asset Management. In this episode, Rajeev talks about developing a sound investing character, lifelong learning, building an antifragile life, and much more.

Ep. 15 – Guy Spier on Finding Your North Star, Reciprocity, and the Power of Compounding Goodwill

Guy Spier is founder and investment manager at Aquamarine Capital, and author of The Education of a Value Investor, one of the best books I have read about someone’s personal journey in life, business, and investing. In this episode, we talk about Guy’s ideas of finding your North Star, compounding goodwill, the immense power of reciprocity, and much more.

Ep. 14 – Arnold Van Den Berg on Constructing a Good Life and the Power of Subconscious Mind

Arnold Van Den Berg is the Chairman and CEO of Century Management and among the best investors in the world. In this episode, we talk about Arnold’s 80+ years experience in winning a losing hand, constructing a good life, and the power of subconscious mind.

Ep. 13 – Ramesh Damani on Focus, Backing Up Your Truck, and Lessons from the Wizards of Dalal Street

Ramesh Damani is a member of the Bombay Stock Exchange and one of the most successful, well-read and erudite investors in India. In this episode, we talk about the importance of focus in investing, backing up your truck, his key lessons from the wizards of Dalal Street, and much more.

Ep. 12 – Sankaran Naren on Market Cycles, Common Sense, and Art of Being a Contrarian Investor

Sankaran Naren is the Chief Investment Officer at ICICI Prudential AMC, and among the most respected names in the Indian fund industry. Among other things, in this episode, we talk about his idea of contrarian investing, the challenges he has faced over the years and key lessons learned.

Ep. 11 – Monika Halan on Money Mantras, Biggest Financial Regrets, and Handling Life’s Real Wealth Well

Monika Halan is one of the rare voices of sanity in the Indian personal finance space and author of the best-selling book Let’s Talk Money. In this episode, we talk about the key foundational lessons on money, women and money – what needs to change, key money mantras for a balanced financial life, and much more.

Ep. 10 – Barry Ritholtz on Survivorship Bias, Thinking Independently, and Creating Meaning in Life

Barry Ritholtz is the Chairman and Chief Investment Officer of Ritholtz Wealth Management. He is also the creator and host of Masters in Business, the most popular podcast on Bloomberg Radio. In this episode, we talk about using life’s deficits as superpowers, lessons for young people wanting to enter finance, most important mantra for investors, and much more.

Ep. 9 – Samit Vartak on Success vs Happiness and the Art of Managing Other People’s Money

Samit Vartak is the Founding Partner and Chief Investment Officer of SageOne Investment Managers. Samit talks about success vs happiness, Vedanta philosophy, his stock research process, and the art of managing other people’s money.

Ep. 8 – Harsh Mariwala on Risk-Taking, Dealing with Failures, and Building a Sound Corporate Culture

Harsh Mariwala is the Founder and Chairman of Marico, the iconic Indian home-grown MNC. Mr. Mariwala talks about building the right corporate culture, business opportunities in India, and developing ability to take risks and deal with failures.

Ep. 7 – Saurabh Mukherjea on Compounding, Wealth Creation, and Seizing the India Opportunity

Saurabh Mukherjea is the Founder and CIO of Marcellus Investment Managers and author of notable books like Coffee Can Investing and Diamonds in the Dust. Saurabh talks about the opportunities in investing in India and the wealth creation that lies ahead for those prepared to benefit from the same.

Ep. 6 – Sanjay Bakshi on Teaching, Spirituality, and Dealing with Uncertainties in Life and Investing

Prof. Sanjay Bakshi is the Managing Partner at ValueQuest Capital and one of India’s best-recognized finance professors. Among other things, we talk about the idea of being a teacher, spirituality, and dealing with uncertainties in life and investing.

Ep. 5 – Morgan Housel on Seeking Simplicity in a Complex World

Morgan Housel is a partner at Collaborative Fund and author of The Psychology of Money. Among other things, Morgan shares his idea of writing, key lessons he learned from his parents and the ones he wishes to pass on to his kids, the most important thing money can buy, and practicing simplicity in a complex world.

Ep. 4 – Mohnish Pabrai on Reinventing Yourself

Mohnish Pabrai is the founder and Managing Partner of Pabrai Investment Funds. Among lessons on life, investing, decision making, and taking risks, Mohnish talks about the biggest lessons he has learned from the people with whom he has been the closest in life – his father, Warren Buffett, Charlie Munger, Nick Sleep, and Guy Spier.

Ep. 3 – Radhika Gupta on Living a Brave Life

Radhika Gupta is the MD & CEO of Edelweiss Mutual Fund. She has often been ranked amongst India’s most powerful young women in business. She is also a writer, storyteller, public speaker, and ‘a girl on a mission.’ We cover a lot in this episode, about her life as a CEO, the challenges she has faced along the way, and her ideas for the young generation.

Ep. 2 – Vinod Sethi on Listening to Your Inner Voice

Vinod Sethi served as Managing Director of Morgan Stanley Investment Management, until February 2001 and served as its Chief Investment Officer and Portfolio Manager for 12 years. We cover a lot in this episode, including listening to your inner voice, role of intuitive thinking in decision making, cultivating curiosity for lifelong learning, and much more.

Ep. 1 – Manish Chokhani on the Business of Life

Manish Chokhani is one of India’s most respected financial market experts. We cover a lot in this episode, and this conversation is going to teach all its listeners a lot about life than just thinking, learning, and investing.

Subscribe On

The Story Behind “One Percent”

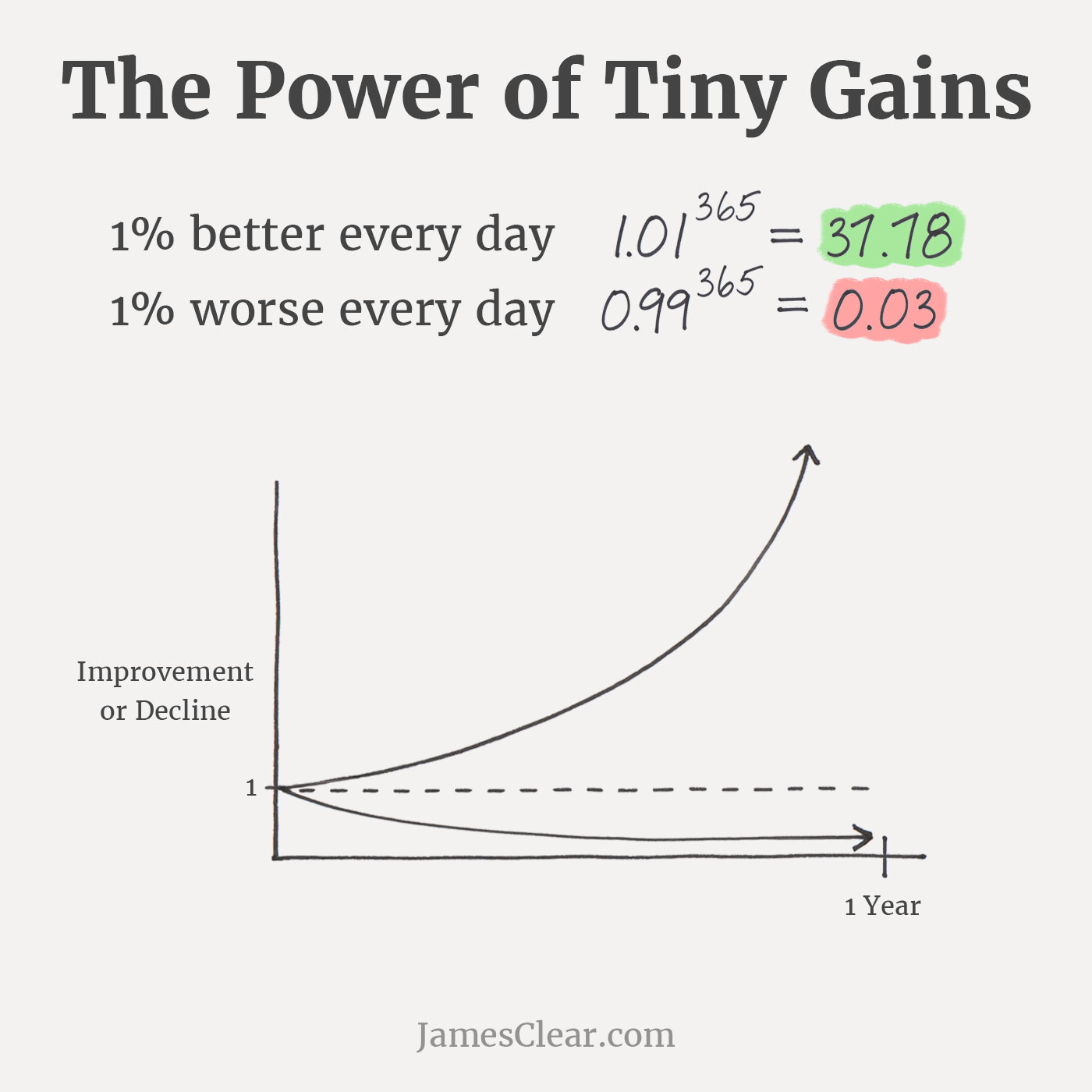

Benjamin Franklin said, “Little strokes fell great oaks.” Warren Buffett advised, “Life is like a snowball. The important thing is finding wet snow and a really long hill.” The Japanese have talked for centuries about Kaizen, which means ‘small continuous improvements.’ And you must have seen this equation – 1.01365 = 37.8.

What this equation and the accompanying advice really means is that instead of trying to make radical changes in a short amount of time, if you can just make small improvements – just 1% better – every day, that will gradually lead to the change you want in your life.

Each day, just focus on getting 1% better in whatever it is you are trying to improve. That’s it. Just 1%.

What does 1% a day mean? Nothing, really. It just means get a little better each day – as simple as reading one page of a book per day, or watching one TED talk per day, or exercising for only five minutes per day. It is hard to quantify. But the important thing to know is this – One percent better each day, compounded, is almost 3800% better each year. Big change, with just one percent.

James Clear wrote in his book, Atomic Habits –

I like to refer to habits as the compound interest of self-improvement, and the reason why I like that phrase is that, the same way that money multiplies through compound interest, the effects of your habits multiply as you repeat them over time…[I]f you can get just one percent better each day, so .01365, you end up 37 times better by the time you get to the end of the year.

That is the idea behind The One Percent Show. To take you on an open-ended exploration into the minds of the wisest people around whose insights and wisdom can help you learn to think, invest, decide, and live each day a little, as little as one percent, better.

Thank you for being a part of this initiative. I look forward to walking with you on this journey of self-improvement, step by step, one percent by one percent.

* * *

Please share this initiative with others on WhatsApp, Twitter, LinkedIn, or just email them the link to this page.

If you wish to receive updates on new episodes and all my posts straight into your email, subscribe below to my free newsletter – The One Percent Letter – that offers practical, time-tested ideas on learning, thinking, decision-making, and the pursuit of a simple, happy life.

With respect,

— Vishal